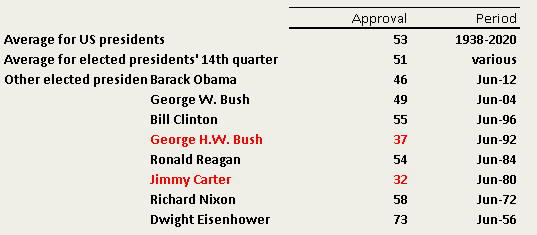

Yesterday’s Presidential debate was more like a WWE Smackdown event than a political discord. The big picture point for markets is that the odds of a Biden victory increased as measured by the betting market. However, the equity market had already largely discounted a decent probability of a Biden victory. That said, a “contested election” (the absence of a clear …

Heroic Ambitions

The way price has responded (so far) to the September FOMC suggests that while the statement and forward guidance from the Committee was fairly dovish, it was already well telegraphed (and priced) after Jackson Hole. As we noted a few weeks ago, there are no new catalysts to propel risk assets higher, only extrapolation of existing beliefs. There was also …

The State of Play & the Global Risk Proxy

The S&P500 or global risk proxy is trading just below the record high. While that is still in large part due to the liquidity beneficiaries (technology stocks), there has been a (very) modest rotation into “value” sectors and a coincident rise in Treasury yields over the past two weeks. There are a few forward looking points to note. First, most …

Sky Man

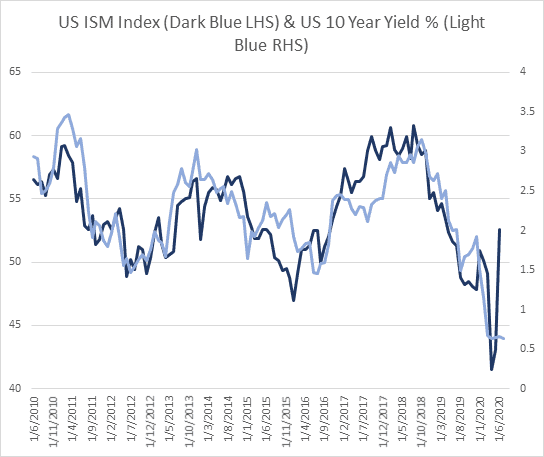

There are some interesting divergences (both bullish and bearish) between price and beliefs that have developed since early June. The Citi economic surprise index has had surpassed expectations at a historic rate. Similarly, the manufacturing and service sector ISM were consistent with a robust rebound in growth. However, liquidity beneficiaries, “stay-at-home” stocks or “growth” continue to outperform “value” in the …

China & Commodity Countries

One of my favourite behavioural case studies from a macro perspective is the rise and fall of Brazil. The currency and the stock market went from complete crisis and revulsion levels of valuation in 2001, to an economic miracle according to the Economist magazine by late 2009. It then proceeded to de-rate again over the following decade until the current …

The Bigger Bazooka

Over the past three months, US equities have continued to outperform emerging market equities (in dollars) despite the more heroic valuation starting point. Jon Garner at Morgan Stanley suggests that the US (and developed markets) are also more likely to outperform emerging market equities looking forward. That would be contrary to the relative performance following the episode in 2008. As …

All Aboard the Manilla Express

The Philippines has long been one of the best macro or secular growth stories in the region. Sustained reforms and prudent macroeconomic policies have supported strong GDP growth and macroeconomic stability. At the same time they have helped to contain external and macro-financial vulnerabilities. While socioeconomic challenges remain, poverty and inequality have declined. The ease of doing business also still …

Fed Promises more Powerful than Actions

In recent notes we have focussed on the central role of the dollar in global liquidity, cross border capital flows and relative returns between US and non-US assets. A range of factors drive the competitiveness of a currency. In the medium term, a reliable measure and cross check for the fundamental (or real effective) value of a currency is whether …

Mind the Gap

With “The Economist” and “Time Magazine” highlighting the yawning gap between the economic data and equity prices, it suggests that the anomaly has become widely appreciated. While the recent economic data have been as bad as anything in the past 100 years, two year ahead earnings expectations have fallen substantially less than the decline in 2008/9. Moreover, investors are willing …

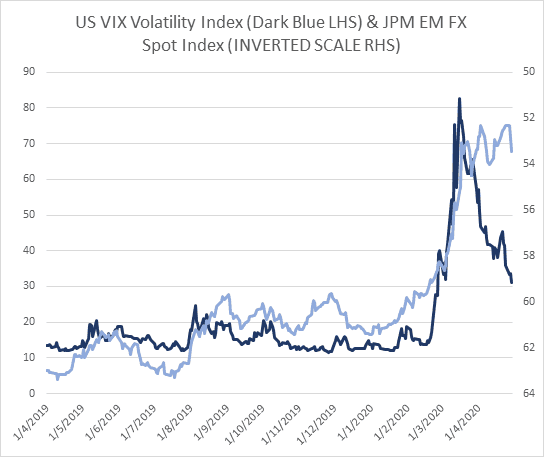

The Emerging Laggard: Part II (An EM Currency Overview)

A few weeks ago we noted that the rebound in emerging market currencies has been very modest relative to the “V-Shaped” recovery priced into US equities. That is true on both a spot currency basis and in terms of the risk premia or carry relative to developed market sovereign yields or equity volatility (chart 1). The JP Morgan Emerging Market …