Yesterday’s Presidential debate was more like a WWE Smackdown event than a political discord. The big picture point for markets is that the odds of a Biden victory increased as measured by the betting market. However, the equity market had already largely discounted a decent probability of a Biden victory. That said, a “contested election” (the absence of a clear result on election night) is probably still a non-trivial risk for markets. On the positive side, the correction through September and sector performance within equities suggests that aggregate risk is also relatively well priced. Typical corrections within an expansion or bull market tend to be 7-10% or similar to the current pull back.

As we noted in July (see “what if the corporate tax cuts are reversed”) the key positive of the current Administration for markets was the passage of the Tax Cuts and Jobs Act in December 2017. That lowered the statutory corporate tax rate from 35% to 21%. As a result, the effective tax rate (the actual tax paid) declined from 28% to 19%. That added $18 to 2018 S&P500 EPS and was a key support for equities until the (Fed induced) normalisation of interest rates contributed to the sharp correction in the fourth quarter of 2018. The tax cuts also reinforced the pre-existing trend increase in corporate debt which had already doubled over the prior decade on a debt-to-revenue basis. Rather than use the windfall gains from the tax cuts to retire debt, US companies increased share buy-backs by $1 trillion in 2018 and 2019 and increased dividends. Therefore, the key risk, reinforced after yesterday’s debate, is that a Biden Administration would halve the Trump tax cut and return on the statutory rate to 28%. If implemented, that would increase the effective rate by around 4-5%, and reduce 2021 S&P500 EPS by around $9. Companies with a higher effective tax rate (generally domestic orientated businesses or the Russell 2000) benefited far more than those with less onerous tax burdens when rates were lowered.

Another important point we made in July is that a Democrat clean sweep is not an obvious negative for markets. Recall that the prevailing bias among sell-side strategists leading into the 2016 election was that a Trump victory would be bearish for markets. The reverse was true likely because of the corporate tax cuts, market friendly regulation and despite the trade war. Stated differently, even if a Biden Administration reverses part of the corporate tax cut it is possible that it might be offset with larger fiscal spending on infrastructure and an improvement in global trade relations. Our point here is not to offer an opinion, but to highlight that if one forecasts an event correctly it is not obvious how price will respond. However, what we do know is that “value” sectors of the equity market like banks, financials and even healthcare are underappreciated if there is a more favourable outcome, stronger-than-anticipated cyclical expansion or normalisation in market interest rates.

On a tactical basis, our sense is that the fall in risk assets through September was probably “corrective” rather than the start of another major drawdown. As Gerard Minack noted recently, Fed tightening or recessions are the primary cause of bear markets. The recession was in the first half of this year and the Fed is not even thinking about, thinking about, tightening policy anytime soon. That said, failure to extend fiscal support measures or a reversal in the fiscal impulse would be a legitimate risk to the expansion and equities. It is also the case that although central bank liquidity and credit support has been dramatic, it might not provide further positive policy surprises from here. As we have noted recently, the key to broadening out of the equity bull market or the rotation of “growth” into “value” equities will likely require sustained expansionary fiscal policy. In contrast, another growth scare might reinforce the current market leadership (of technology and growth sectors) if it forced the Fed to expand QE in the absence of additional fiscal easing. In that scenario we would likely have a preference for Asian technology which trades at an 80% discount to the US technology sector.

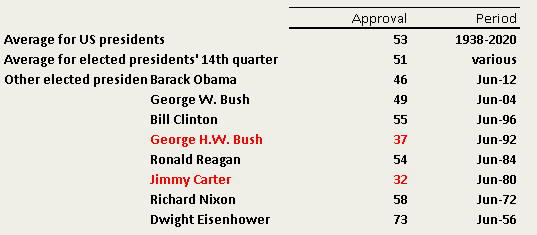

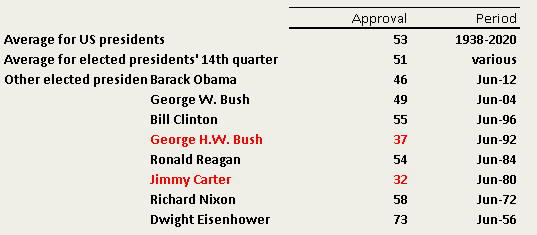

In conclusion and as we noted in July, if Biden wins and the Administration reverses half of the 2017 corporate tax cuts that would have a non-trivial impact on 2021 S&P500 EPS. On the positive side, a Biden Administration might offset that with greater fiscal stimulus on areas like infrastructure and also improve global trade relations. It was widely observed that the polls largely underestimated the Donald in 2016. However, historically when the approval rating falls below 40% that has led to a change in President (chart below).

Source: Gallup

About the Author:

Nick Ferres is CIO of Vantage Point Asset Management. Prior to this, Nicholas was at Eastspring Investments, the Asian asset management business of Prudential plc, as Investment Director, in September 2007. Nicholas was Head of the Multi Asset Solutions team and was responsible for managing the global tactical asset allocation of funds for external institutional and retail clients. Before joining Eastspring Investments, Nicholas worked for Goldman Sachs Asset Management as Investment Strategist & Portfolio Manager. He has more than 20 years of financial industry experience. Nicholas holds a B.A. (Hons) in Economic History and Politics from Monash University, Australia, a Graduate Diploma in Economics and a Graduate Diploma in Applied Finance.