Over the past month there has been an epic battle between the light (monetary and fiscal stimulus) and dark side (economic and earnings weakness) of the force. Currently, the light side of the force is winning. The ever evolving scope and duration of the Federal Reserve’s bond buying program is probably a key reason why the Fed’s April 9 package …

What the Fed Can’t Print

It was another extraordinary day in markets. While the oil market stress that impacted the May WTI crude contract was well appreciated, it was still remarkable that the price of the benchmark contract traded at a negative value on Monday. Of course, the key point is that the real price of oil includes the cost of storage and transportation. If …

Depth versus Duration

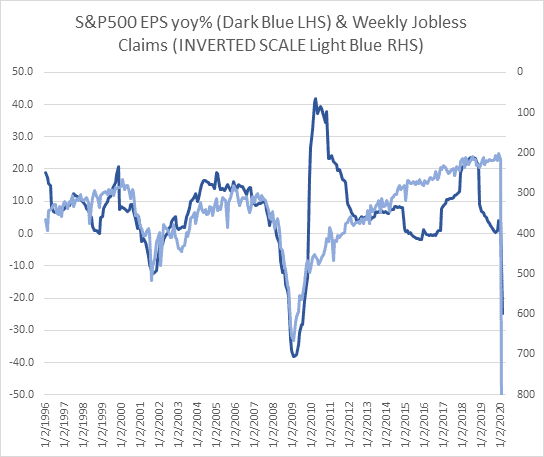

It is an obvious, but often overlooked observation that markets ultimately discount events before they become evident in fundamental news flow. In the recent episode what has been tricky for investors is that the anticipated economic and earnings revision trajectory has fallen so rapidly that it produced a swift decline in equity prices in advance of the macro news flow. …

Productivity & Creative Destruction

As we noted on Good Friday, in most historical episodes markets rarely make definitive lows this early in a recession. A multi-month period of contraction in growth and earnings tends to exacerbate known stress points and contributes to new ones that eventually lead to further de-leveraging and declines in risk assets. However, the strongest argument against a re-test of the …

The Entire Kitchen

Whether the equity and credit markets have already achieved a trough on March 23 will only be obvious with the benefit of hindsight. In real time, investors will, quite rightly, remain concerned about the depth and duration of the recession, the effectiveness of policy stimulus and the magnitude of the second order imbalances and reflexive linkages. There are a few …

Hopium

With the benefit of hindsight it appears as though we are still in the “response phase” sweet spot for equities. With an apparent peak in the US and European COVID-19 infection and mortality rates approaching, markets are choosing to emphasise the positive developments. In particular, the extreme monetary and fiscal policy response with the promise of even more driving the …

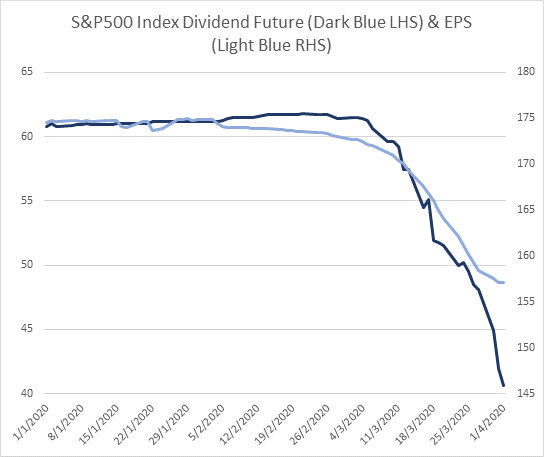

Dividends are Conditional

Back in February when Treasury yields started to approach zero and equity dividend yields started to rise (from a fall in price), the relative spread between the dividend yield and the Treasury yield or cash rate increased to a spicy or enticing level by historical standards. Of course, in contrast to the coupon on a fixed income security, dividends are …

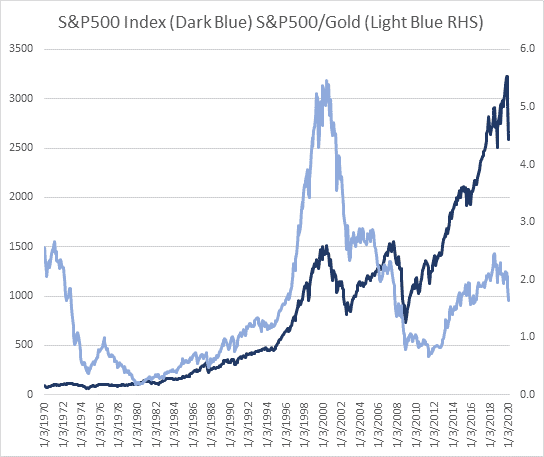

King Dollar & Equities

Over the past 3-6 months, the broad US dollar index has had a 80-90% inverse correlation with equities (chart 1). Therefore, it is probably not a surprise that a (tactical) correction in the dollar over the past week has coincided with a recovery in equities. Of course, policymakers, most notably the Fed, are clearly aware of dollar funding pressures that …

Selling Fatigue

Nothing about this crisis is typical. The velocity of the decline in equities and credit, as well as the size and speed of the policy response are all unprecedented. The catalyst for the downturn was a virus. The cause of the contraction is the deliberate decisions of policymakers to stop activity. The episode has also exposed the magnitude of corporate …

The Full Package

The Bank of England has just delivered a 50 basis point rate cut today at an emergency meeting. Perhaps more importantly, the Bank has also announced targeted lending plans for small and medium sized enterprises. As one observer said, “a surprise rate cut at 7am is enough to make a gentleman choke on his kipper.” The additional point to note …