One of the key features of the recent episode is that the ~$10.5 trillion in global central bank liquidity has kept the bond term premia and credit spreads much more contained than in previous crises (relative to the GDP shock). Indeed, following the recent compression in high yield spreads, credit risk compensation in the US high yield market is back …

A flesh wound

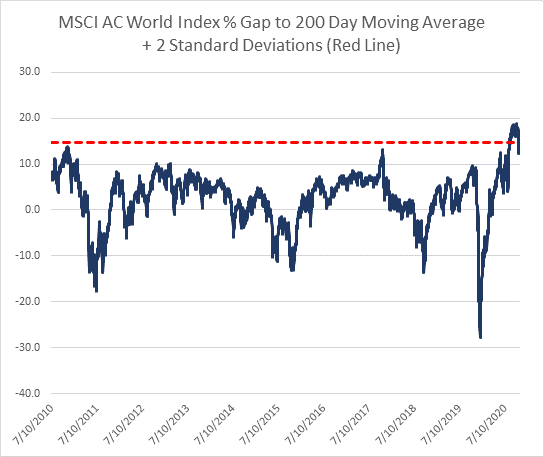

Equity market volatility at the end of January has raised concern in some quarters that there will be a broader and more sustained correction. This follows the observation by a number of high profile “value” investors over recent weeks that equities were in a bubble. While we have some sympathy for that assessment on an outright basis, we have also …

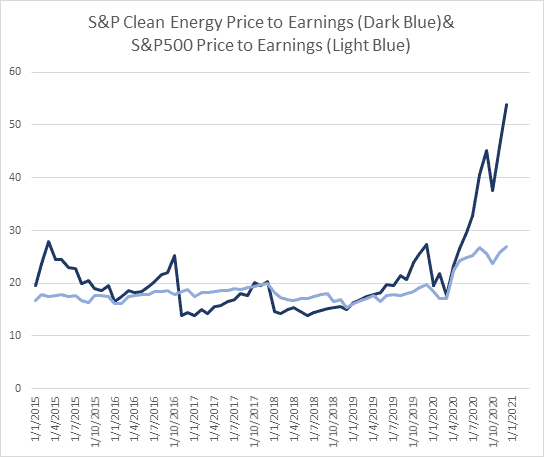

The Green New Deal & Clean Energy

A key potential implication of the mini Blue Wave that has the Democrats controlling the House, Senate and the White House is that the Administration will put-forward friendly clean energy industry legislation. Of course, this was rapidly priced (extrapolated) by the investors. The S&P Clean Energy Index is +66% since the November election +179% over the past year. There are …

The Non-Predictions for 2021

As is customary in December, analysts start to publish their economic and market forecasts for the following year. Of course, the challenge is that it is impossible for human beings to see the future. Given the unprecedented events this year and the nature of the COVID episode most forecasts made at the end of 2019 for this year would likely …

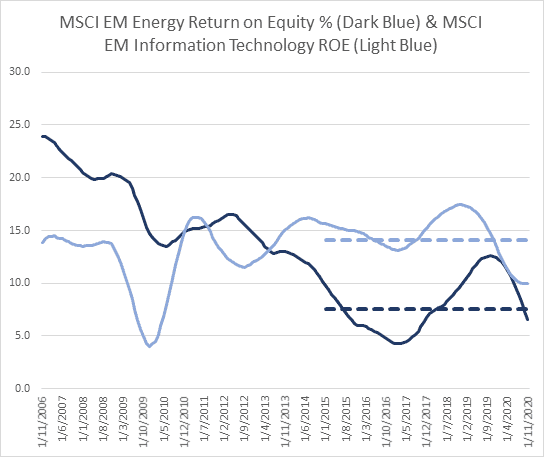

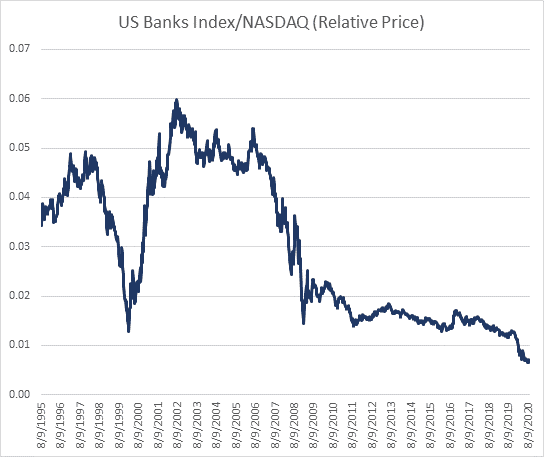

The Least Compelling “Value” Sector

If the global expansion is sustainable, synchronous and supported by policy in 2021 “value” sectors of the world equity markets have a decent probability of out-performing “growth, momentum or low volatility” factors in a tactical sense next year. The historical experience from past cycles suggests that the expansion ought to continue as the cyclical tailwinds following a recession are powerful. …

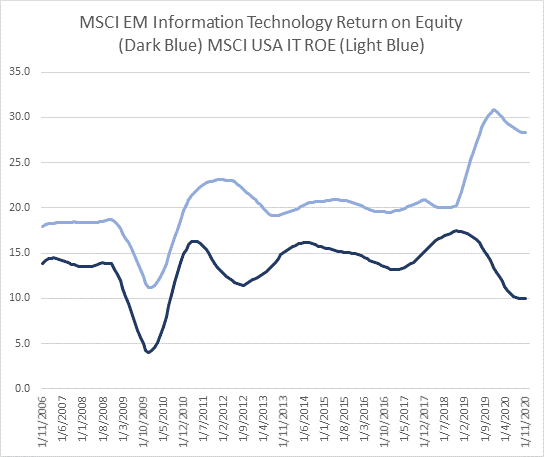

The EM Barbell and the Case for Asian Technology

Our sense is that long EM equities (and short the US dollar) has become a widely held consensus belief. On the positive side, following a decade of underperformance, the secular outlook for emerging (Asian) equites appears very appealing. In relative price, valuation and positioning terms EM/Asia is back to 2003 just after the SARS pandemic and not far above Asian …

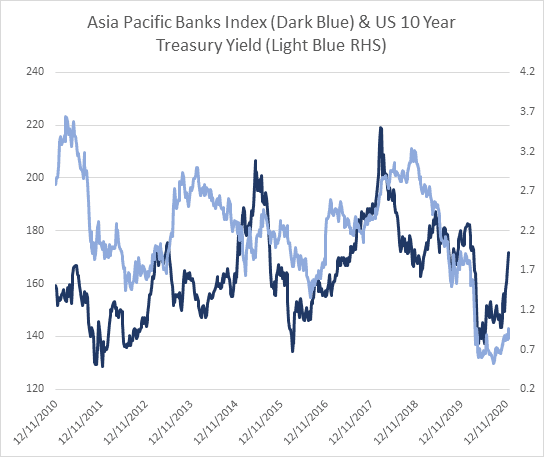

The Case For Asian Banks

Earlier this week we observed that the prevailing bias and positioning suggests that long equity is now a relatively crowded trade or consensus belief. However, that is more of a tactical observation. In contrast, the medium term outlook is still constructive given the early stage of the cycle. Stated differently, forward looking equity prices are likely to rise with the …

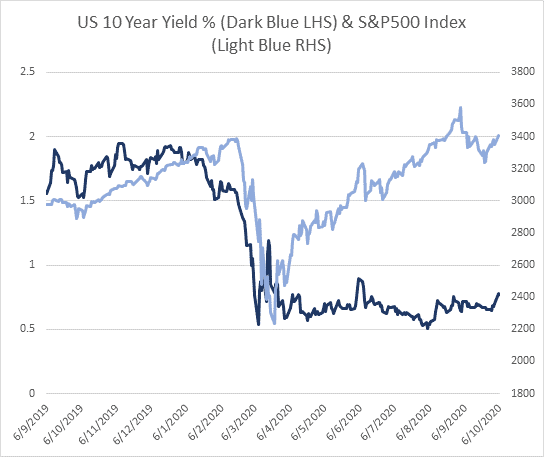

The Asymmetry in Treasuries

While the probability of a Democrat clean sweep or blue wave has increased to more than 70%, according to FiveThirtyEight, the Treasury market and betting odds remain more sceptical. Price action in the Treasury market also likely reflects uncertainty regarding additional fiscal stimulus. Although an agreement seems unlikely ahead of the election, the probability of large additional fiscal stimulus would …

FOFO

From our perch, “risk on/risk off” used to be one of the most irritating acronyms in macro investing as it often ignored important underlying trends or anomalies at the country, sector or single stock level. Over the past few weeks, “fiscal on/fiscal off” or the prospect of whether additional fiscal easing will be delivered appears to be driving short term …

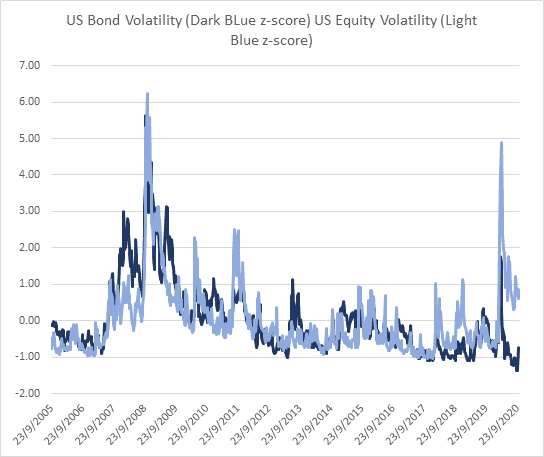

There’s a (Bond) Bear in There

While some analysts including Andrew Sheets at Morgan Stanley have argued that this cycle has been surprisingly normal in terms of how the global growth data have evolved and how many risk assets have responded, from our perch the key difference has been the absence of a rise in long end Treasury yields. As we noted back in August, the …