By focusing on productivity, Vietnam’s economy can converge with South Korea’s in a decade or so DURING President Joe Biden’s short visit to Hanoi, the United States upgraded its partnership with Vietnam and offered support for semiconductor chip manufacturing. These closer links reflect the US’s recognition of Vietnam’s growing importance in supply chains and Indo-Pacific geopolitics -and comes just two …

The Cyclical versus Secular Shock

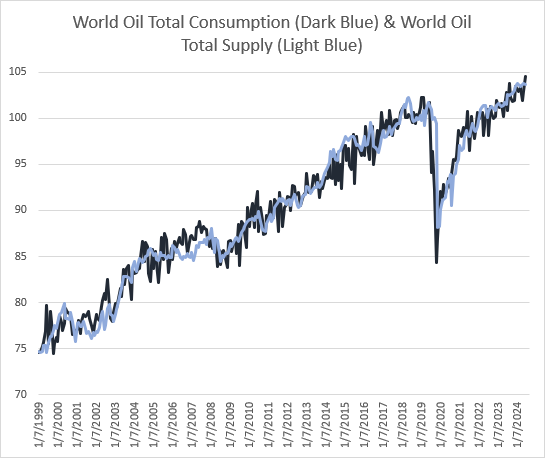

An observation we made last year was that the medium-term or secular arithmetic for energy was relatively straightforward. Resources are depleting fast because the easier and cheaper to extract have already been extracted. At the same time, the global population is still growing and therefore energy consumption is still expanding at a similar trend pace to recent history. In that …

Smokey & the (credit) bandit

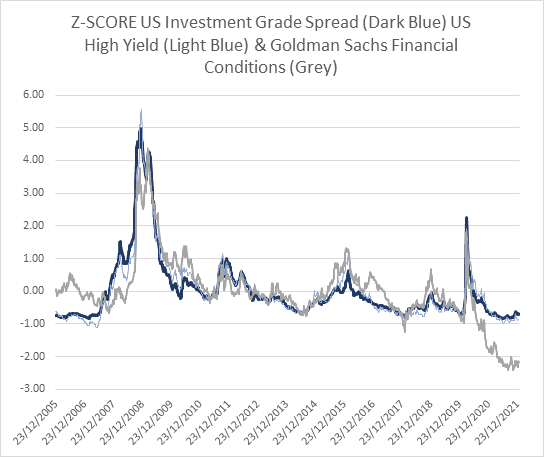

As we often note, it is important to ask: what is your quarrel with price? While markets are not efficient, it is a heroic assumption to say that they are collectively “wrong”. However, what you might suggest is that investors are complacent given some of the information we know about the probable path of interest rates, the dollar, and the …

Vantage Point Cuts Asia Tech as Market Capitulates on Rates

Ferres cautions that US rates may climb to as high as 6% Hedge fund sells out of Alibaba, Tencent, Samsung, TSMC By Richard Henderson (Bloomberg) — Asian technology stocks will remain unattractive as the dollar rallies in tandem with investors capitulating on bets for interest rate cuts from the Federal Reserve, according to Vantage Point Asset Management’s Nicholas Ferres. “Everything that …

The Non-Predictions for 2023 (with Presentation/Chart Pack attached)

By now many of you would have seen several outlook reports for 2023 from the sell-side or large buy-side firms. Most start with a set of forecasts on growth, inflation, and interest rates to drive their asset class and sector return estimates. The challenge with this approach is that human beings cannot see the future. Even if we could accurately …

Kryptonite

In a 2021 note we discussed the Ouroboros (Greek word meaning tail devourer) as a metaphor for the financial alchemy driving the modern feedback loop between liquidity, leverage and volatility. The Ouroboros is the ancient symbol of a snake consuming its own body in perfect symmetry. In extreme heat a snake, unable to self-regulate its body temperature, will experience an …

Too Much Doom in the Room

As we often note, a behavioural episode is typically characterised by; a rapid and violent movement in price; focus on a single story; and occasions when price is potentially inconsistent with fundamentals. The first element – rapid price action – helps distinguish something from a cyclical, emotional or short term overreaction and a legitimate fundamental structural problem. The single story …

Cognitive Dissonance

From our perch, it is plausible that markets are experiencing a phase of cognitive dissonance on inflation and policy risk. Cognitive dissonance is the perception of contradictory information that causes stress when two actions or ideas are not psychologically consistent with each other. The prevailing bias appears to be that the conflict in Europe suggests that the Federal Reserve less …

Peak (Inflation) Fear?

One of the key ways we describe a behavioural episode, is when market participants are focused on a single story. Or put another way, when a key risk factor has become the widely accepted prevailing bias and front page news. In the current episode, everyone is now obsessed with inflation and the potential policy and market consequences. That suggests we …

Loose as a Goose

In Australia, a “goose” is a light hearted term to describe someone who is a bit foolish. A more derogatory term might be a “flaming galah.” Last week we noted that the US Federal Reserve might be committing a costly policy error based on the false premise that inflation is pending a normalisation through supply side adjustment. The recent strength …