Earlier this week we observed that the prevailing bias and positioning suggests that long equity is now a relatively crowded trade or consensus belief. However, that is more of a tactical observation. In contrast, the medium term outlook is still constructive given the early stage of the cycle. Stated differently, forward looking equity prices are likely to rise with the expansion in profits. It suggests that any equity correction would likely represent a buying opportunity.

Markets are forward looking and have priced the recovery in earnings and compression in risk premiums rapidly following the fastest and broadest policy response in history. The forward looking challenge in some sectors of the equity and credit markets is that current yields leave limited room for capital appreciation. Although as we noted above, earnings growth should support equity returns next year. Multiple expansion via a further decline in rates or credit risk premia appears less likely going forward. On the positive side, risk perceptions (or premia) does tend to be positively correlated with profit growth – it is pro-cyclical.

In our non-predications for 2021 released earlier this week we suggested that there was still considerable asymmetry or positively skewed odds in Asia Pacific equities relative to US equities. Within Asian equities “value” sectors of the market are particularly under-appreciated relative to the US market. From our perch, one of the best expressions of the value factor is the banking sector within Asia Pacific. Asian banks currently trade at an 81% discount to the US stock market on a price to book basis (chart 1). However, return on equity (profitability) is only at a 30% discount in relative terms. Asian banks also offer a sustainable dividend yield of 4% that is 2.5 percentage points higher than the dividend yield on the US stock market.

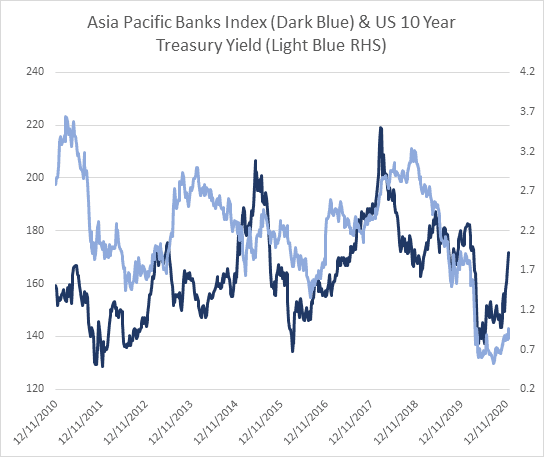

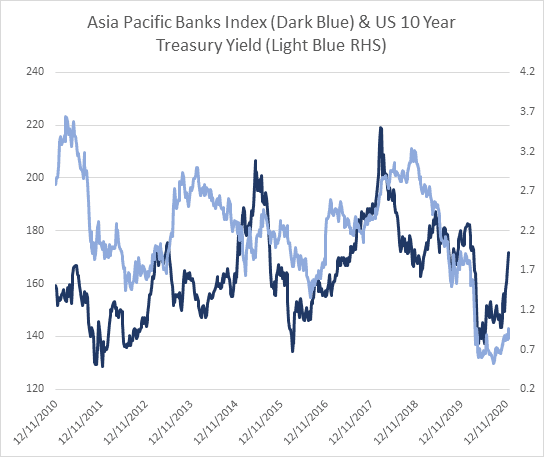

There are two additional points to note. First, like banks in other regions, Asia Pacific banks tend to out-perform in phases of accelerating growth and rising sovereign yields as that tends to expand net interest margins and profitability (chart 2). Second, credit penetration in the less developed markets in Asia remains low relative to the advanced economies. As a result, there is stronger potential trend growth in emerging banks in Asia. While stronger credit growth tends to lead to future risk, leverage ratios are generally low in emerging Asia. As we have often noted in the past, credit is inflationary when taken on and deflationary when paid back.

In conclusion, the asymmetry in Asia Pacific bank valuations relative to US equities is quite extreme. Asian banks are also under appreciated in an outright sense trading at 75% of book value with close to 11% trend return on equity. Of course, the secular out performance of US equities (led by mega cap technology) has been genuinely driven by earnings/cash flows and currency over the last decade. In that sense it has not been a short term emotional overreaction but something legitimate and fundamental. However, the strength of the policy response combined with the potential for high rates as growth recovers could lead to a shift in the regime.

About the Author:

Nick Ferres is CIO of Vantage Point Asset Management. Prior to this, Nicholas was at Eastspring Investments, the Asian asset management business of Prudential plc, as Investment Director, in September 2007. Nicholas was Head of the Multi Asset Solutions team and was responsible for managing the global tactical asset allocation of funds for external institutional and retail clients. Before joining Eastspring Investments, Nicholas worked for Goldman Sachs Asset Management as Investment Strategist & Portfolio Manager. He has more than 20 years of financial industry experience. Nicholas holds a B.A. (Hons) in Economic History and Politics from Monash University, Australia, a Graduate Diploma in Economics and a Graduate Diploma in Applied Finance.