Equity market volatility at the end of January has raised concern in some quarters that there will be a broader and more sustained correction. This follows the observation by a number of high profile “value” investors over recent weeks that equities were in a bubble. While we have some sympathy for that assessment on an outright basis, we have also noted a few important qualifications. First, we are only at the beginning of a new economic and market cycle. Second, liquidity remains overabundant and likely to remain supportive with inflation well below the Fed’s target. Third, the equity risk premium or the gap between equity and fixed income yields remains supportive for stocks. The final point to note is that medium term flows and positioning and the reaction to the late January correction suggest elevated volatility aversion among investors. To be fair, as we indicated last week, short term tactical indicators were quite frothy.

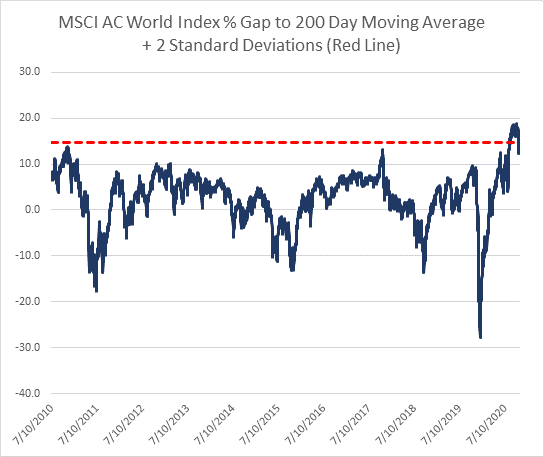

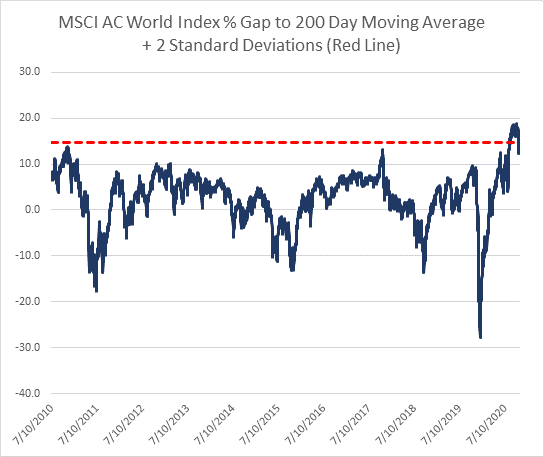

We highlighted tactical risk (“it’s a bit frothy”) ahead of the recent correction. As a result, we had scaled back our net long equity position from 40% at the start of 2021 to 20% by late January. From our perch, the prevailing bias had become too enthusiastic on global growth and reflation in the short term. Tactical indicators such as investor surveys, cash levels in mutual funds and demand for call relative to put options had become stretched. From a pure price perspective, the world index was also trading more than two standard deviations above its 200 day moving average or primary trend. Taken together, this indicated that the odds of a consolidation was likely (chart 1).

On the positive side, the most important bull-case for global and Asia Pacific equities is that we are only at the beginning of the economic and market cycle. Clearly markets are forward looking and price has recovered rapidly from the lows in the March quarter of last year in anticipation of the recovery in earnings. However, recent good news on the vaccine roll out and the strong support from monetary and fiscal policy ought to drive consumption, global trade, demand for goods and higher inflation. Given the experience over the past decade, the probability of unintended policy tightening is probably low. Large excess capacity is also likely to constrain the rise in core inflation and an pre-mature withdrawal of liquidity. In that context, any market correction caused by re-positioning in the levered community or as a result of short term volatility aversion is an opportunity to add to equity positions.

At the FOMC meeting last week, the Fed again pushed back on the suggestion that there was excessive (over)valuation in financial assets or that there is a strong relationship between equity prices and interest rates. However, as we see it, anchoring future short rate expectations and asset purchase programs are specifically designed to encourage lending (credit) and an allocation into risky assets. Put another way, superabundant liquidity ought to support equity prices. The key challenge to the risk premium support for equities is when the extremely low level of bond yields reflects secular stagnation or a permanently lower trend growth outlook (e.g. Europe or Japan). In the case of Asia Pacific, our sense is that it reflects genuine relative value in equity relative to fixed income as trend growth ought to recover in cyclical terms with limited leverage constraint compared to the developed world.

In conclusion, the correction in equities in late January is probably a consolidation rather than the start of a more sinister de-leveraging phase in markets for the following reasons; 1) we are only at the beginning of the new economic and market cycle; 2) liquidity is overabundant; 3) policy is likely to remain supportive; and 4) equity remains attractive relative to fixed income. Markets are forward looking and equity prices rallied aggressively in anticipation of the cyclical recovery. However, risk compensation remains attractive in a number of key areas, most notably in Asia Pacific.

About the Author:

Nick Ferres is CIO of Vantage Point Asset Management. Prior to this, Nicholas was at Eastspring Investments, the Asian asset management business of Prudential plc, as Investment Director, in September 2007. Nicholas was Head of the Multi Asset Solutions team and was responsible for managing the global tactical asset allocation of funds for external institutional and retail clients. Before joining Eastspring Investments, Nicholas worked for Goldman Sachs Asset Management as Investment Strategist & Portfolio Manager. He has more than 20 years of financial industry experience. Nicholas holds a B.A. (Hons) in Economic History and Politics from Monash University, Australia, a Graduate Diploma in Economics and a Graduate Diploma in Applied Finance.