An observation we made last year was that the medium-term or secular arithmetic for energy was relatively straightforward. Resources are depleting fast because the easier and cheaper to extract have already been extracted. At the same time, the global population is still growing and therefore energy consumption is still expanding at a similar trend pace to recent history. In that context, starving fossil fuel producers of capital might not be a very wise decision. Unfortunately, the conflict in Eastern Europe has also amplified these pre-existing trends. In the shorter term, the cyclical outlook for demand might remain weak if there is a recession in the United States.

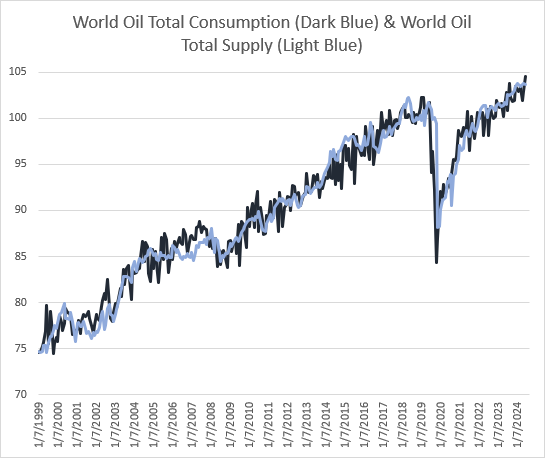

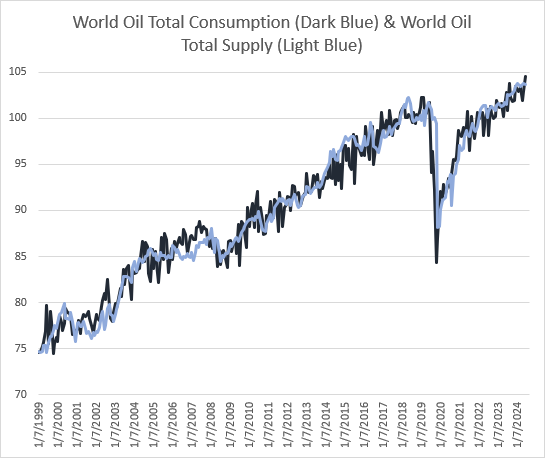

Over the past 20 years, governments’ have spent around $5 trillion on “green energy.” While that has reduced the fossil fuel share of energy from 86% to 84%, world oil consumption has increased from around 77 million barrels per day to around 100 million barrels per day. Consensus estimates suggest oil consumption will continue to increase to around 107 million barrels per day by 2030 (chart 1).

Currently, public listed companies contribute around 50% of global supply, but if future capital spending is constrained by the ‘Net Zero’ target and reduced supply from Russia, non-public companies (primarily from OPEC) will likely be required to increase supply. The bottom line is oil prices might increase rather than decrease because of the climate pressure on public oil companies. Of course, that might also accelerate technological innovation and the pivot away from fossil fuels. Therefore, the prevailing bias on trend demand and supply might be wrong.

Capital spending from public listed energy companies has halved over the past decade. On the positive side for shareholders, this has contributed to a material improvement in return on assets (chart 2). The free cash flow yield has also improved over the period to around 14%% or a 6.8% premium relative to global equities (chart 3). Of course, reduced capital spending will eventually constrain future returns. However, with energy prices elevated, producers have the potential to earn super normal profits.

The cyclical demand outlook might remain weak if there is a hard landing in the United States later this year. The correction in spot crude oil from $110 in mid-2022 to $81, is consistent with the weakness in ISM manufacturing and other leading indicators of final demand (chart 4). Curiously, the weakness in the manufacturing ISM has also led changes in the 1 year forward curve for crude (chart 5).

Extending one’s time horizon beyond the cyclical outlook for demand, the global energy sector appears inexpensive at a 14% free cash flow yield. A large proportion of that cash is likely to be returned to shareholders. Of course, part of the required investment for energy transition away from fossil fuels might have to be undertaken by the listed energy companies which might impact future cash returns (directly or via government taxes).

A broader implication of starving the sector of capital when global energy consumption is still expanding might be higher trend inflation or costs of production in other sectors. It also might increase the probability of a supply-side shock and constrain central banks from responding with lower rates and more liquidity in an inflationary bear market. Many of the largest episodes in history have been triggered by an energy crisis. For humankind, hopefully technology wins.

About the Author:

Nick Ferres is CIO of Vantage Point Asset Management. Prior to this, Nicholas was at Eastspring Investments, the Asian asset management business of Prudential plc, as Investment Director, in September 2007. Nicholas was Head of the Multi Asset Solutions team and was responsible for managing the global tactical asset allocation of funds for external institutional and retail clients. Before joining Eastspring Investments, Nicholas worked for Goldman Sachs Asset Management as Investment Strategist & Portfolio Manager. He has more than 20 years of financial industry experience. Nicholas holds a B.A. (Hons) in Economic History and Politics from Monash University, Australia, a Graduate Diploma in Economics and a Graduate Diploma in Applied Finance.